Register

Worth Ave. Group - Providing peace of mind to consumers for over 50 years.

10 Reasons to Get Insurance for Your Phone, Laptop, or Tablet

Posted:

August 24, 2022

Categories:

General

Do you use your smartphone for practically everything? Do you heavily rely on your laptop? Do your kids have iPads and Chromebooks they use for school and entertainment? If so, getting insurance protection for your devices has probably crossed your mind. Which brings us to a question most likely all of you wondered about at some point: Is phone, laptop, or tablet insurance worth it? If you are unsure whether device insurance is a good investment, you may be surprised to hear that there are many reasons why protecting your phone, laptop, or tablet with an insurance plan can be a smart choice, and here are some of them.

Device insurance is affordable

Contrary to what you might think, device insurance is affordable and worth every penny when you unexpectedly need to repair or replace your device. For instance, you can insure an $800 iPhone with Worth Ave. Group for just $9.25 a month. Or a $700 laptop for just $6.50 a month. You can get coverage for your $429 iPad for just $5 a month. That’s less than a lunch or movie ticket! So, would you rather pay a few dollars a month to get coverage in case your phone, laptop, or tablet gets accidentally damaged or stolen or spend hundreds of dollars out of pocket to repair or replace your device?

Repairing or replacing a device is costly

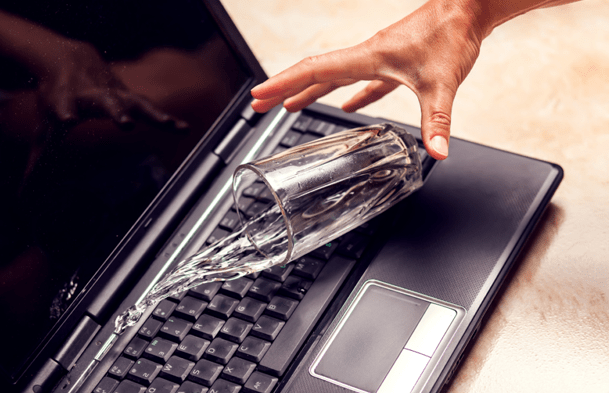

If you drop your phone on the ground and crack its screen, repairing that cracked screen could cost you up to $329. If you spill coffee all over your laptop and need to replace the system board, this can cost you up to $600. And what if your child steps on their iPad, crushing the screen and its internal components? Only the screen repair can cost up to $599, not to mention repairing the broken internal parts! Looking at these staggering figures, those few dollars a month to protect your device from accidental damage doesn’t sound bad, right?

Repair shops and self-repair can be unreliable

As phones, laptops, and tablets have become more common, an increasing number of repair shops have appeared on every corner in every city. Unfortunately, not all of these repair shops are reliable. Professional repairs are expensive, but some repair shops choose to offer cheap repair services at the expense of repair quality. And if you fall victim to a poor repair service, in the end, you will pay more to fix the mistakes made by inexperienced technicians. So again, the repair can easily cost you much more than an insurance plan.

Self-repair can be risky. You can buy parts online and give-a-go yourself and try to save a buck, but laptops, phones, and tablets have small delicate parts. You could risk damaging your device even more. DIY is not recommended for device repair. It’s best to leave repairs to the professionals and save cost and hassle with insurance.

Device insurance covers things that a standard warranty does not

Although a warranty might be the first thing that comes to mind regarding issues with your phone, laptop, or tablet, standard warranties cover only mechanical defects and failures, not accidental damage and theft. So, if you crack your phone screen, your child spills juice on their laptop, or if someone steals your tablet, a warranty is useless, but your device insurance has your back! The entire point of getting insurance for your devices is to protect them against what the manufacturer's warranty does not cover. Moreover, Worth Ave. Group insurance plans offer coverage in the event of a fire, flood, natural disaster, vandalism, and power surge caused by lightning!

Device insurance saves you time and hassle

Device insurance doesn’t only save you money, but it also saves you time and hassle. If you accidentally damage your device, think about all that hassle of finding a trustworthy repair shop. And then wait for the device to be repaired and given back to you. But, if you have device insurance from Worth Ave. Group, you don’t have to waste time looking for repair shops and go through all that hassle. All you have to do is file a claim, which takes only a few minutes. And after your claim is approved, we will ensure that your device is repaired and back in your hands in no time.

Cases do not provide enough protection

Although getting a protective case for your phone, tablet, or laptop is a good idea, you should know that these cases can only protect your device to a certain degree, and in some cases, they cannot protect it at all. Yes, cases can’t prevent damage from every accidental drop, and they can’t prevent cracked screens. And they certainly can’t protect your device from getting stolen or suffering damage due to liquid submersion or power surge caused by lightning, let alone fire, flood, or natural disaster. But, device insurance can protect you from all these incidents.

Accidents can happen anytime and anywhere

Everyone would like to think, “It won’t happen to me,” but the reality is that accidents can and do happen. Accidents are called accidents for a reason – they happen when you least expect them. No matter how careful or responsible you are, a few seconds is all it takes for an accident to happen, whether that means dropping your phone or spilling water on your laptop. And think about all the accidents that could occur when your child has an iPad or Chromebook in their hands or backpack. The good thing is that insurance can protect you when accidents happen.

Devices can be attractive targets for thieves

Have you ever thought about what would happen if your valuable phone, tablet, or laptop gets stolen? Phones, laptops, and tablets are expensive devices, which makes them attractive targets for thieves. And theft can happen anywhere. For example, someone can steal your phone at a coffee shop, your laptop from your parked vehicle, or even your child’s backpack with an expensive iPad at the park. If your device or your child’s device gets stolen, you would have to replace it, which can be extremely expensive. Having device insurance can help you by covering the cost of a replacement device.

Filing a claim is easy

Are you still on the fence about getting device insurance because you think filing a claim will be complicated and time-consuming? We have some good news for you: filing a claim with Worth Ave Group is easy, simple, and fast, which is another reason to get protection for your devices. You can file a claim 24/7 online from the comfort of your home. If you don’t have Internet access or need help, our customer service will walk you through the process. To find out more about our claim submission process, go to worthavegroup.com/claim-submission.

Peace of mind is priceless

Last but not least, peace of mind is everything. If you’ve ever been in a situation where your phone, laptop, or tablet was accidentally damaged or stolen, or you know someone who has, then you know how stressful it is. One of the best ways to ease stress in such situations is to get insurance for your devices. Remember, device insurance gives you peace of mind that comes with knowing that your devices are protected and that your insurance company will come to the rescue if something happens to them.

The bottom line is there are more than a few reasons why you should not hesitate to get insurance protection for your valuable devices, like your phone, laptop, or tablet. From saving you money, time, and hassle to giving you peace of mind, the benefits of having device insurance are undoubtedly huge. So, if you are ready to protect your devices with an insurance plan, go to worthavegroup.com/product to get a free quote!