Register

Worth Ave. Group - Providing peace of mind to consumers for over 50 years.

Comprehensive Chromebook Insurance Coverage for Students, Schools, and Personal Use

Losses Covered

| Cracked Screens | ||

| Spills & Liquid Submersion | ||

| Accidental Damage (Drops) | ||

| Theft & Vandalism | ||

| Fire, Flood & Natural Disasters | ||

| Power Surge By Lightning |

NOTICE: Caution Against Fraud - Any person who, with intent to defraud or knowing that he/she is facilitating a fraud against an insurer, submits an application or files a claim

containing a false or deceptive statement is guilty of insurance fraud which is a Federal Offense.

Comprehensive Chromebook Insurance for Students, Schools, and Individuals

Affordable Coverage for Accidental Damage, Theft, and More – Protect Your Device Today!

Keep your Chromebook protected with a Worth Ave. Group comprehensive insurance protection plan. Whether you have a student device looking for school device coverage or simply using a Chromebook for personal use, our coverage offers peace of mind against accidental damage, theft, spills, and more. With low deductibles and unlimited claims, purchase insurance you can trust to help keep your device safe, so you can focus on what matters most.

K-12 Districts and SchoolsChromebook Insurance

Chromebook

Comparison ($350)

Comparison ($350)

Insurance or protection plan

Theft coverage

Accidental damage

Liquid submersion

Power surge by lightning

Used / refurbished coverage

Unlimited claims

Purchase anytime

Cancel anytime

Repair locations

Non-repairable

Monthly or in-full payment

Deductible

Policy term

Premium

Worth Ave. Group

Insurance

In-network

Replacement / reimburse

Both on select terms

$50

Two years

$88

GeekSquad

Protection plan

In-network

Replacement

In-full

$4.99 - $199.99

Two years

$139.99

SquareTrade

Protection plan

In-network

Replacement / reimburse

In-full

$50

Two years

$89.99

Plan comparison based on Two-Year Full Coverage Insurance protection plan and minimum deductible available of $50. The device used in this comparison has a retail value of up to $350. Prices (including processing fees) and terms are as of 6/12/2025 and may change at any time. Pricing may vary by state.

This website does not provide detailed information or interpretation of specific insurance contracts, policies, and/or policy language, and is not designed to be a substitute for such information in terms of claims handling and/or settlement. For complete coverage information, please refer to the applicable specific policy in its entirety, including all applicable endorsements.

What schools are saying...

What parents are saying...

One of the major advantages of having device insurance is reducing out-of-pocket expenses when accidents happen. Whether it’s a cracked screen, water damage or a dropped device, a Worth Ave. Group policy will ensure you’re covered.

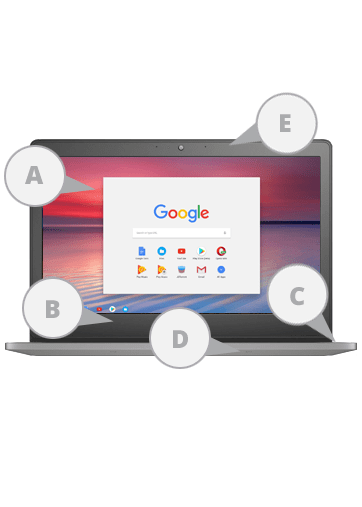

A: Glass/LCD - $125 - $225

Tossing your Chromebook in a backpack as you haul it between classes could easily lead to a cracked screen. This can be a pricey repair to pay for out-of-pocket.

Tossing your Chromebook in a backpack as you haul it between classes could easily lead to a cracked screen. This can be a pricey repair to pay for out-of-pocket.

B: Cracked Casing - $50 - $120

Accidentally dropping or stepping on your Chromebook could end up breaking the outer casing. This can be an expensive repair.

Accidentally dropping or stepping on your Chromebook could end up breaking the outer casing. This can be an expensive repair.

C: Headphone Jack - $100 - $200

Getting water (liquid damage) in your headphone jack could cause it to malfunction. This repair isn’t covered by a manufacturer’s warranty.

Getting water (liquid damage) in your headphone jack could cause it to malfunction. This repair isn’t covered by a manufacturer’s warranty.

D: System Board - $150 - $300

Spilled something on your Chromebook while doing homework? This could cause severe damage to the system board, which could require a complete replacement. If you don’t want to end up paying for this out-of-pocket, make sure you’re insured.

Spilled something on your Chromebook while doing homework? This could cause severe damage to the system board, which could require a complete replacement. If you don’t want to end up paying for this out-of-pocket, make sure you’re insured.

E: Replacement Chromebook - $200 - $1,000

Chromebooks are essential in most classroom settings, so losing yours to theft or natural disaster means you would need to buy a replacement. This can be extremely expensive to pay for out-of-pocket.

Chromebooks are essential in most classroom settings, so losing yours to theft or natural disaster means you would need to buy a replacement. This can be extremely expensive to pay for out-of-pocket.

Repair estimates based on average out-of-pocket costs in the United States without device insurance, extended warranty, or protection plan. Pricing published on 6/2/2025 and may change at any time. Repair parts and labor costs will vary depending on the repair facility and make and model of the device.

What is Chromebook insurance?

Chromebook insurance is a policy that helps protect your device from accidental damage, theft, or other perils not covered by the manufacturer's warranty. Providing repair and replacement assistance at the time of an incident.

Why should I get Chromebook insurance?

Insurance can provide peace of mind in case your Chromebook is damaged or stolen. It can save you the cost of repairs or replacements if something happens to your device.

How to insure a Chromebook for students?

You can get started by obtaining a Chromebook insurance Quote. Parents and individuals can generate a quote at the top of this page, add a plan to your cart and finish checkout. Your policy details will be emailed to you.

K-12 school districts can get a quote for Chromebook insurance with no deductible on our school device coverage page. One of our reps will send you a quote ready with savings! K-12 device protection that includes more Chromebook damage coverage than your school Chromebook warranties.

K-12 school districts can get a quote for Chromebook insurance with no deductible on our school device coverage page. One of our reps will send you a quote ready with savings! K-12 device protection that includes more Chromebook damage coverage than your school Chromebook warranties.

What does Chromebook insurance cover?

Coverage typically includes: Accidental damage (e.g., drops, spills, cracked screens), theft, vandalism, fire, flood, natural disasters, and power surge by lightning

Is Chromebook insurance worth it?

It depends on how you use your Chromebook and how careful you are with it. If you’re prone to accidents or your device is expensive, insurance might be a good idea.

What’s the difference between warranty and insurance?

A warranty typically covers defects in materials or workmanship for a limited time. Insurance, on the other hand, can cover accidental damage, theft, or repairs after the warranty expires or if yours is still active.

How much does Chromebook insurance cost?

Costs vary depending on the device value, but it generally ranges from $20 to $100 per year.

Will Chromebook insurance cover new, used, or refurbished devices.

Yes. If it's brand new out of the box, renewed, or you've had it for a while. You can get coverage.

How do I file a claim for Chromebook insurance?

The claims process generally involves filing a claim online, explaining the issue, and providing proof of damage or theft. You may need to submit a police report in the case of theft, vandalism, or fire.

How long does Chromebook insurance last?

Insurance typically lasts for one year, but you can repurchase it annually. Some plans may offer coverage options for additional years.

Is there a deductible for Chromebook insurance?

Many insurance policies include a deductible, which is the amount you need to pay out-of-pocket before the insurance coverage kicks in. The deductible amount varies depending on the plan.

Can I cancel?

Yes, our policies allow you to cancel at any time. Just contact customer service for assistance.